Table of Contents

- Pennsylvania Solar Incentives. Unlock the Power of Solar Energy with ...

- Solar Power New Brunswick | Statistics & More — Sunly Energy

- How Solar Incentives From the Government Work (and What Happens When ...

- Solar Incentives: A Guide to Finding Them in Your Area | IWS

- best solar incentives - Walker Reid Strategies

- Go Solar Incentive - Atticity

- Oregon Solar Incentives 2025 - Steven Vega

- Solar Brisbane - Solar Incentives

- Federal Solar Incentives: A Comprehensive Guide - SolarSena

- Are Solar Incentives Still Available For|Articles

What is the Solar Tax Credit?

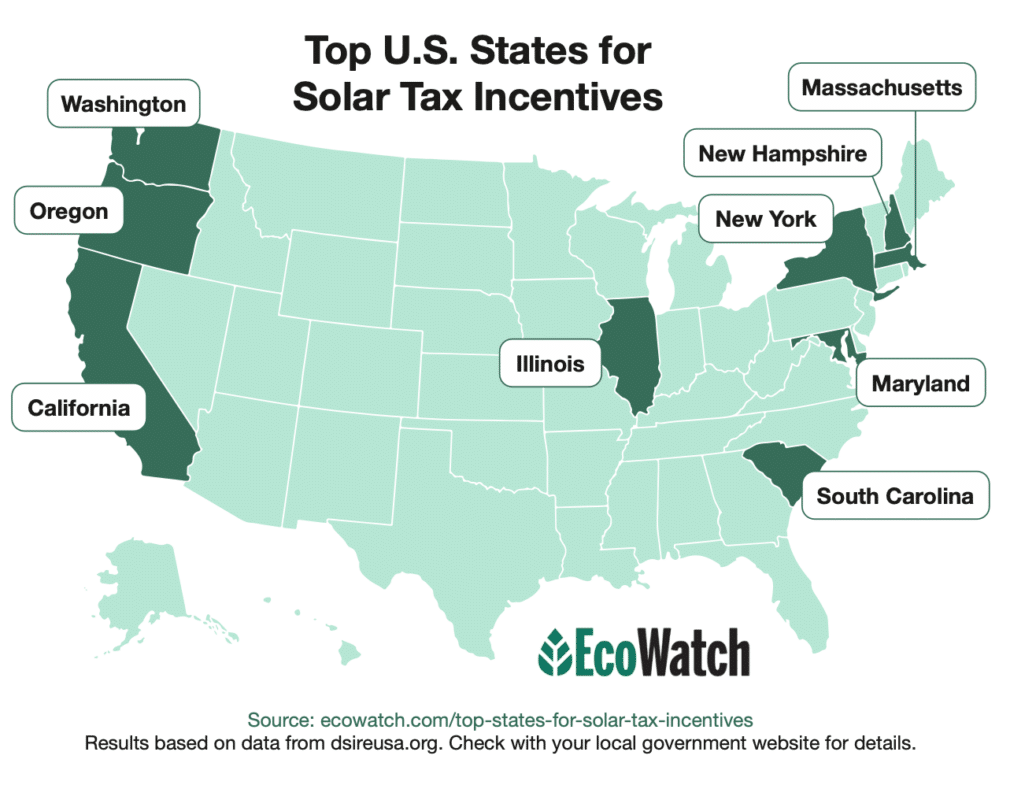

Solar Tax Credit by State

How to Claim the Solar Tax Credit

To claim the solar tax credit, homeowners will need to meet the following requirements: The solar panel system must be installed on a primary or secondary residence. The system must be installed by a qualified solar installer. The system must be operational by December 31 of the tax year. Homeowners must have a tax liability to claim the credit. To claim the credit, homeowners will need to file Form 5695 with their federal tax return, along with a copy of their solar panel system receipt and installation certificate. The solar tax credit is a valuable incentive for homeowners who want to reduce their energy bills and carbon footprint. By understanding the solar tax credit by state, homeowners can take advantage of additional incentives and savings. Whether you're in California, New York, or Texas, there are solar tax credits and incentives available to help you unlock the savings of solar energy. So why wait? Contact a qualified solar installer today to start harnessing the power of the sun and saving on your energy bills.Forbes Home is a leading provider of home improvement solutions, including solar panel installations. Our team of experts can help you navigate the solar tax credit and other incentives available in your state. Contact us today to learn more about how you can start saving with solar energy.

Note: The information contained in this article is for general purposes only and should not be considered as professional tax advice. Homeowners should consult with a tax professional to determine their eligibility for the solar tax credit and other incentives.